APPLY FOR PERSONAL LOAN

Collateral-free personal loan with lowest interest rate is just a few clicks away from you. Apply Personal Loan online and fulfill your dreams without worrying about money.

Features & Benefits of Personal Loan

- No Collateral Required: Personal loans don’t require collateral, as it is an unsecured loan making them accessible and removes the risk of losing assets in case of default.

- Flexibility in Usage: Personal loans offer flexibility in how the funds can be used. Borrowers can utilize the loan for various purposes such as debt consolidation, home improvement, medical expenses, etc.

- Customizable Tenure Period: Borrowers can choose a repayment tenure that suits their financial situation. Longer tenures may result in lower monthly payments, while shorter tenures may reduce the interest rate.

- Quick Approval: Personal loans have a quick approval process. Online application options and instant approval systems help borrowers receive funds quickly.

- Minimal Documentation: Personal loans usually require minimal documentation. Basic identification and income proof are the major requirements.

- Fast Disbursement:

Once approved, personal loans offer quick disbursal of funds, which is beneficial in emergencies or urgent financial needs.

What is a Personal Loan?

The term personal loan has emerged as a boon for individuals seeking quick and hassle free access to funds. Personal loan is a financial tool that offers unparalleled flexibility and convenience to borrowers. Unlike traditional loans, a personal loan is unsecured, meaning you don’t have to provide any collateral to secure it.

With Udhar Capital Personal Loan you can say goodbye to lengthy approval processes and mountains of paperwork. Our application process ensures that you can get the funds you need when you need them, without the unnecessary delays. We are committed to providing you with the best financial solutions.

Types of Personal Loans

Medical Emergency

Marriage Loan

Home Renovation Loan

Gadgets & Appliances Loan

Travel Loan

Education Loan

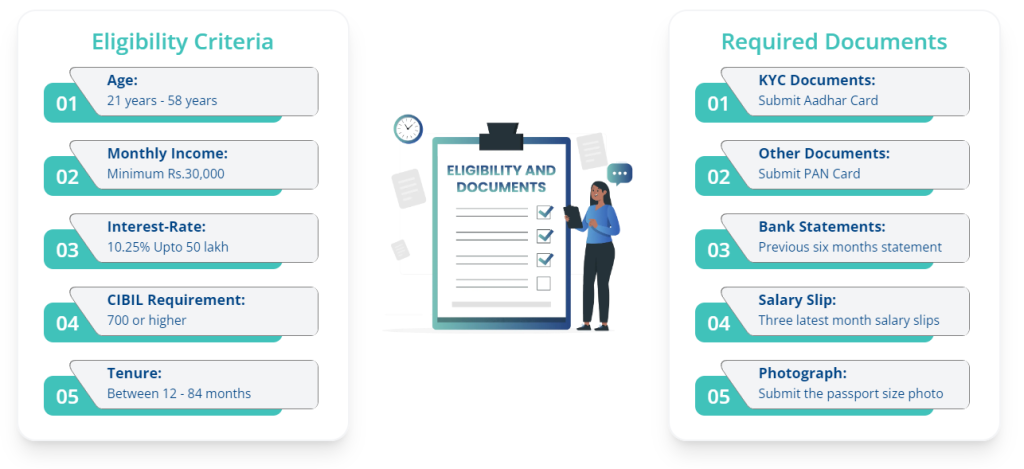

Eligibility & Documentation for

Personal Loan

Strategies to improve your odds of securing a Personal Loan

Since the personal loan is an unsecured loan, this nature of personal loan increases the credit risk, as it leaves them with no collateral or security. To mitigate this risk of personal loan, banks and NBFCs factor in various aspects of their credit history and follow strict eligibility policies when looking at their loan applications. Borrowers those who are planning to avail personal loan can strategically improve the chance of getting approved for the personal loan, so here are some tips discussed below for it:

- Maintaining your CIBIL score is first and the most important tip, so you need to maintain your score above 700.

- It is advised that reviewing your credit report on a regular basis for inaccuracies is crucial, as the error occurred can lower your credit score and also may diminish your loan approval chances.

- Do compare the offers of personal loan available from Banks and NBFCs before finalising your loan deal.

- Apply for the loan from a Bank/NBFC where you are sure about the highest chances of approval of personal loan.

Factors affecting Personal Loan Interest Rate

There are many factors which determine the interest rate of your personal loan:

- Credit History: The key factor which plays crucial role in the approval of personal loan. Credit history not only determines your eligibility but along with it also affects the interest rate. High credit scores help in building the lender’s trust in the borrower’s financial behaviour.

- Monthly Income: People with higher income usually have higher potential for repayment of loan so people with higher income receive the loan with lowest interest rate.

- Repayment History: The borrower will track the record of your repayments of your debts according to your interest rate. A consistency and timely repayment history of your loan results in the lower interest rate, demonstrating reliability to lenders.

- Status of Employer: Interest rate depends on this factor too. In which company you are working with, the reputation and financial stability of the employer plays a vital role over here as it signifies the reliability and potentially impact the interest rate of the borrower.

- Bank Relations: Long standing and positive relation with the bank lead to preferential rates or more flexible terms for the borrower and impact the interest rate of loan.

The Personal loan interest rates primarily influence the total cost of your borrowing. So, before applying one must always look for the best interest rates available by the different banks on their credit profile.

Personal Loan Details

| Interest Rate | 10.25% p.a. onwards |

| Processing Fees | NIL |

| Loan Tenure | 12 to 84 Months |

| Late Payment Charges | According to Lender’s Rule |

How to apply for Instant Personal Loan?

1

Visit Udhar Capital

Website

2

Fill in the

Form

3

Get Instant

Approval

4

Get Instant

Disbursal

Compare Personal Loan rates from our top lenders

HDFC Bank

Max. Loan Amt.

Up to Rs.50L

Rate of Interest

10.25% - 13%

Tenure up to

Upto 6 Years

Processing fee

Up to 2%

24 Hours Disbursal*

100% Digital Process*

Quick Disbursal

Axis Bank

Max. Loan Amt.

Up to Rs.40L

Rate of Interest

10.25% - 14%

Tenure up to

Upto 1-5 Years

Processing fee

Up to 2%

Low Processing Fee

Kotak Mahindra Bank

Max. Loan Amt.

Up to Rs.10L

Rate of Interest

10.99% - 14%

Tenure up to

Upto 5 Years

Processing fee

Up to 1%

Lowest Income requirement

100% Digital Process*

IDFC First Bank

Max. Loan Amt.

Up to Rs.1Cr

Rate of Interest

10.50% - 14%

Tenure up to

Upto 7 Years

Processing fee

Upto 1%

Max Loan Amount

100% Digital Process*

ICICI Bank

Max. Loan Amt.

Up to Rs.50L

Rate of Interest

10.99% - 14%

Tenure up to

Upto 1-7 Years

Processing fee

Up to 1.5%